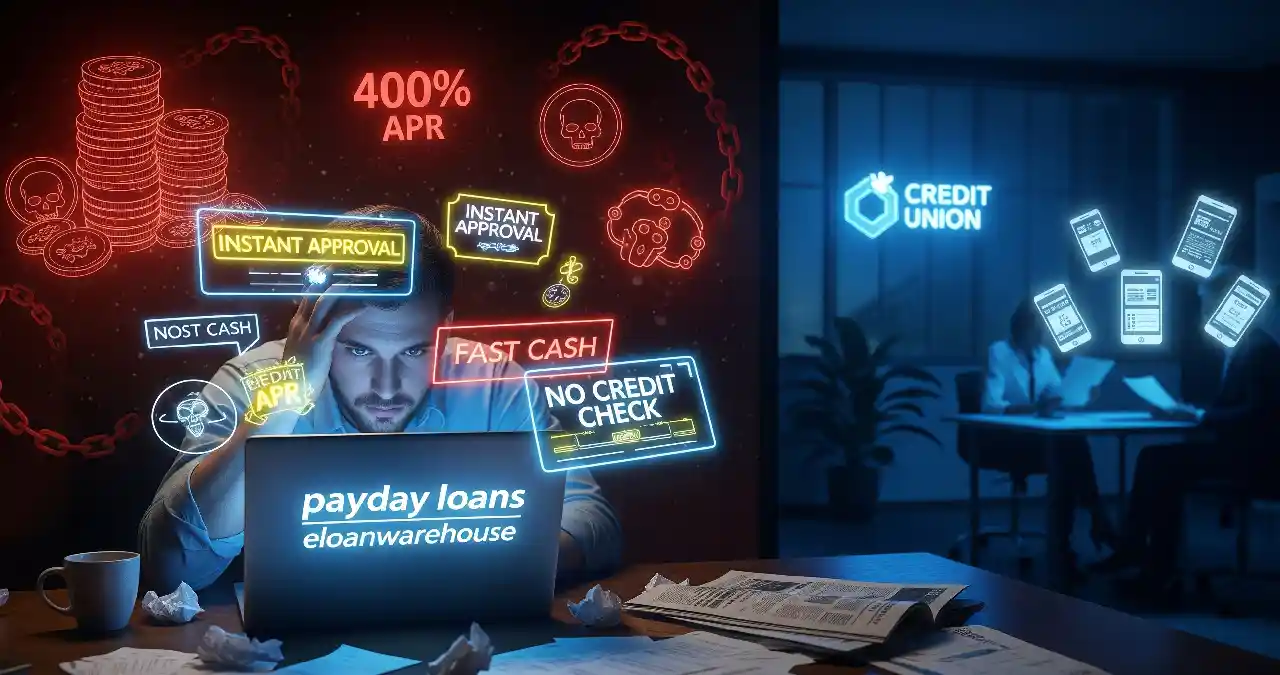

Need fast cash before payday? Bills pile up, rent is due, and a surprise fee just hit your account. You’re Googling at midnight and see shiny promises from payday lenders. It looks simple. But is it smart?

Short-term loans can carry triple-digit APRs, rollover traps, and aggressive repayment schedules. Miss one due date and the fees snowball. Your next paycheck shrinks, leaving you stuck in a borrow–repay loop. If you’re considering payday loans eloanwarehouse, you deserve the full picture: current rates, state rules, and risks many ads skip.

This guide breaks it down—clear, fast, and practical. You’ll learn how these loans work in 2025, what protections apply, and where the real costs hide. Then we compare safer options—credit-union small-dollar loans, payment-plan negotiations, cash-advance apps, and employer programs—so you can choose confidently and avoid debt spirals. Ready to protect your paycheck and breathe easier?

Table of Contents

What Is eLoanWarehouse & How Payday Loans Work

What is eLoanWarehouse? Brand overview & user intent match

eLoanWarehouse is an online installment-loan and line-of-credit provider that markets “payday loan alternatives,” with funding as soon as the next business day (sometimes same day) after verification. It operates as Opichi Funds, LLC d/b/a eLoanWarehouse, a sovereign enterprise of the Lac Courte Oreilles Band of Lake Superior Chippewa Indians, and lists loyalty tiers up to $3,000 for returning customers. If you’re searching for payday loans eloanwarehouse or “eLoanWarehouse payday loans,” you’re likely comparing fast-cash options—this guide explains costs, rules, and safer picks.

How payday loans work in plain English

A payday loan is a short-term, small-dollar advance typically due on your next paycheck. It often carries triple-digit APRs and may trigger bank debits on your due date. State rules vary widely; some cap APRs or ban payday loans, while others allow high costs. The CFPB’s payment provisions now limit repeated failed withdrawal attempts from your account.

Is eLoanWarehouse Legit? Safety, Licensing & State Availability

How to check licensing & accreditation

Start with three checks:

- Company site disclosures: eLoanWarehouse states it’s a tribal lender regulated by its tribe (not by states) and that loans are provided by Opichi Funds, LLC.

- BBB profile: The BBB lists “eLoan Warehouse” as A+ accredited (since May 18, 2023) with a Wisconsin address. BBB is not a regulator, but the profile shows patterns of complaints and how the company responds.

- Regulator databases: Use your state regulator (e.g., WA DFI) to see if a lender is licensed; tribal lenders often aren’t state-licensed and may be flagged in state alerts. Also search the CFPB Complaint Database for trends.

Bottom line: “Legit” means know who regulates the lender and which laws apply. Tribal lenders assert sovereign immunity and follow tribal law plus federal rules (e.g., the CFPB’s payment provisions), not state licensing.

State availability & legal limits

eLoanWarehouse says it does not lend in New York, Pennsylvania, Virginia, or Connecticut, and availability can change. Many states cap APRs (often at 36%) or ban high-cost payday loans entirely, while others permit very high rates—policies that influence what products are offered locally. If you live where licensing is required, your state may warn that tribal entities aren’t licensed even if they lend online. Always confirm current availability on the lender’s site and review your loan agreement for governing law and dispute resolution.

Eligibility & Requirements at eLoanWarehouse

Typical requirements

Expect: age 18+, verifiable income, active checking account, and U.S. residency in an eligible state. eLoanWarehouse notes no loans to active-duty military or their dependents (Military Lending Act). Credit assessment may rely on alternative bureaus, not necessarily the big three (Experian/Equifax/TransUnion). Early payoff has no fee. Funding may be same day after underwriting/e-signature and bank compatibility; otherwise next business day.

Who should/shouldn’t consider a payday loan

Consider only if a small, urgent expense and a clear payoff plan exist. Avoid if you’re already overdrawn, expect irregular income, or might need to roll over repeatedly. High costs and automated withdrawals can strain tight budgets; check safer alternatives first (see below) and review CFPB protections on payment attempts.

Costs: APR, Fees & Total Cost of Borrowing

Typical fees & APR ranges; example repayment math & total cost

Payday-style credit often runs at triple-digit APRs. In permissive states, advertised APRs can exceed 400%; some maps show ranges up to 662% for classic two-week payday loans. Installment loans marketed as “payday alternatives” can still be high-cost; actual APRs depend on amount, term, and your profile and should be disclosed in the Truth in Lending box. Example: borrowing $500 at 200% APR over 6 months could mean $100–$120 in monthly payments and $100–$200+ in total finance charges—exact figures vary by rate/fees. Always read your agreement; eLoanWarehouse’s homepage doesn’t post a public APR table.

Late fees, rollovers, NSF fees, collections & credit impact

Missing payments may trigger late fees, additional interest, and potential NSF/returned-item fees if debits fail. The CFPB’s payment provisions restrict lenders from making more than two consecutive failed withdrawal attempts without new authorization—reducing excessive bank fees. Defaults can lead to collections and may appear in alternative credit reports; impact varies because some lenders use non-traditional bureaus. Avoid rollovers; extend only if the plan truly lowers costs.

Application Process (Step-by-Step) at eLoanWarehouse

Online application fields

You’ll submit:

- Personal details (name, contact, ID)

- Employment/income info (pay schedule, amount)

- Banking (routing/account for deposits and ACH repayments)

- Consent to verify data and accept e-signature documents.

Returning borrowers may see loyalty tiers with higher limits.

Verification, approval timelines, funding speed, cut-off times

After you apply, a representative may call to verify details. If underwriting, e-signature, and validation complete before the lender’s cut-off (and your bank supports same-day credits), funding can arrive same day; otherwise next business day. Track status on the mobile app. If timing matters (rent/utility deadlines), apply early on business days and confirm bank processing windows.

Comparing eLoanWarehouse to Alternatives

Key differentiators

Speed: Same-day in some cases; commonly next business day.

Amount/terms: Up to $3,000 for returning borrowers; terms up to 12 months in the top tier.

Structure: Installment and line-of-credit vs. single-payment payday.

Regulatory posture: Tribal regulation vs. state-licensed models.

Support: Phone support and app account management; BBB shows both praise and complaints—review recent patterns.

Side-by-side comparison table

| Lender | Min/Max Amount | Typical Fee/Cost | Funding Speed | State Availability | Rollover Policy |

| eLoanWarehouse | $300–$3,000* | High-cost installment; APR disclosed in agreement | Same day (some), else next business day | Most states; not NY, PA, VA, CT; tribal-regulated | No classic payday “rollover”; installment schedule |

| Competitor A (Credit Union SDL) | $200–$1,000 | Capped APR (often ≤36%) | 1–2 business days | Members in served states | N/A |

| Competitor B (Cash-Advance App) | $20–$500 | Tip/fee model; no APR | 1–2 business days | Most states | N/A |

Real Customer Experiences: Pros & Cons

Common positives

Customers often cite quick decisions, simple online steps, and transparent amortizing schedules compared with single-payment payday loans. Some praise same-day/next-day funding and no early payoff fee, which can cut total cost if you repay faster.

Common negatives

Recurring themes in public complaints include high costs, confusion about payoff amounts, difficulty reaching support, and collection disputes. The BBB shows hundreds of complaints in recent years. A 2023 class-action alleges a “rent-a-tribe” scheme; that’s an allegation, not a court finding, but it underscores the need to read agreements closely.

Responsible Borrowing Checklist

Pre-borrow budget check

- List net pay for the next 2 cycles.

- Subtract fixed bills (rent, utilities, food, transport).

- Is the one-time expense truly urgent?

- Will the new payment fit without overdrafts?

- If not, pause and review alternatives.

Clear exit plan

- Choose the shortest term you can safely afford.

- Set autopay reminders and verify bank balance.

- Avoid extensions/rollovers; they balloon costs.

- Use any windfall to prepay principal (no fee).

- After payoff, build a $300–$500 buffer to avoid repeat borrowing.

Smarter Alternatives to Payday Loans

Lower-cost options

- Credit-union small-dollar loans (SDLs): Usually ≤36% APR, fixed payments, and member support.

- State-licensed installment lenders: Some offer longer terms at lower costs than payday; compare APR and total of payments.

- Employer paycheck advances/EWA: May offer no-interest advances with fees lower than payday.

- BNPL (use carefully): Split purchases over time; avoid stacking plans.

State laws drive what’s available and how much it can cost—check your state’s payday/instalment rules before applying.

Non-debt solutions

- Bill-by-bill plans: Ask medical, auto, or landlord for payment plans.

- Utilities/phone: Hardship or LIHEAP-type programs may lower current bills.

- Local assistance: Community orgs and agencies can help with food/rent.

- Income boosts: Temporary overtime, micro-gigs, or selling unused items reduce how much you must borrow.

How to Improve Approval Odds

Accurate application data, steady income proof, clean bank history, avoid multiple simultaneous applications

- Enter exact employer, pay dates, and income.

- Upload current pay stubs or bank statements if asked.

- Keep your account positive—avoid recent NSFs before applying.

- Don’t shotgun multiple applications in a day; alternative bureaus may track inquiries.

- Request only what you can repay early; there’s no prepayment fee, so a smaller loan plus a rapid payoff is cheaper than stretching the term.

FAQs

How fast is funding?

Same day in some cases after verification/e-signature and bank support; otherwise next business day.

Do they run a credit check?

They may use alternative credit repositories rather than traditional bureaus; impact varies.

Can I get a loan with bad credit?

Possibly; approval depends on income, bank history, and lender criteria.

States where loans are not available

eLoanWarehouse lists NY, PA, VA, CT as unavailable; availability may change.

How are fees calculated?

All APR/fees appear in your loan agreement. Public APR tables aren’t listed on the homepage; costs can be high for small-dollar credit.

What happens if I miss a payment?

You may incur late/NSF fees and collection activity. The CFPB rule limits repeated failed debits without new consent.

Can I repay early without penalty?

Yes, no early payoff fee is advertised.

Are there rollover limits?

Installment products don’t use classic payday rollovers; ask about extensions/deferrals and total cost before agreeing.

Are online applications secure?

The site displays trust badges and an app; still, use secure networks and keep copies of agreements.