Closing a bank account might feel like a hassle, but sometimes it’s the smartest financial move. If you’re wondering how to close Chase checking account, you’re not alone.

Problem: Many people get stuck paying monthly maintenance fees, juggling multiple accounts, or simply feeling unhappy with the services. It can be frustrating when your money feels harder to manage than it should.

Agitation: Maybe you’re switching banks for better interest rates, consolidating accounts to simplify your finances, or just tired of surprise charges. Holding on to an unused or costly account only adds stress — and potentially unnecessary fees.

Solution: The good news? Closing a Chase account doesn’t have to be complicated. In this step-by-step 2025 guide, you’ll learn the exact process, what to prepare beforehand, and the best ways to avoid common pitfalls. By the end, you’ll know exactly how to move forward with confidence.

Table of Contents

Reasons to Close a Chase Checking Account

Why would someone close a Chase checking account? Here are the most common reasons:

- High monthly maintenance fees – Unless you meet balance or deposit requirements, Chase checking accounts often carry fees that can eat into your money over time.

- Better offers from competitors – Many online and regional banks now offer higher interest rates, cashback debit cards, or fee-free checking, making Chase less attractive.

- Digital-first banks – Fintech apps and online-only banks are more convenient for people who prefer managing everything on their phones.

- Relocation or lifestyle changes – If you move to an area with limited Chase branches or simply want to consolidate accounts, closure makes sense.

In short, closing your Chase account is often about saving money, gaining better features, or simplifying your finances.

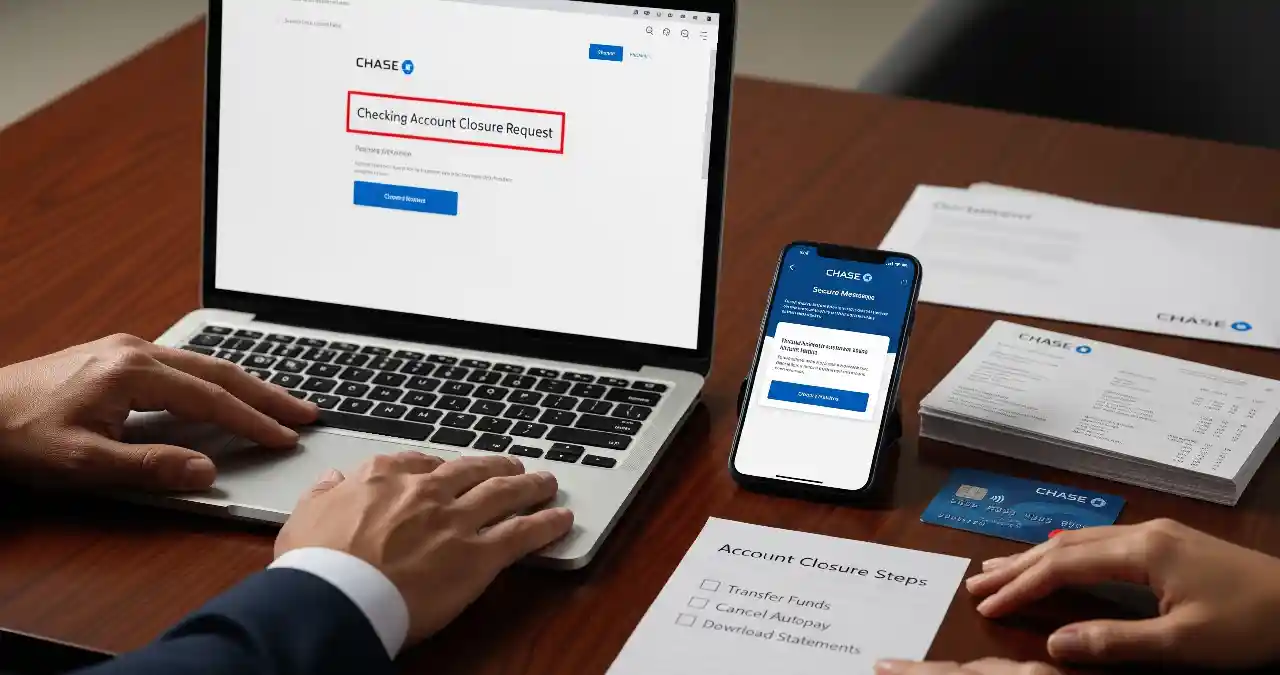

Things to Do Before Closing Your Chase Account

Before you shut down your account, take these critical steps to avoid headaches:

Move Your Money and Stop Auto Payments

- Transfer your funds to a new account.

- Cancel autopay for bills, subscriptions, or credit cards to prevent failed payments.

Clear Pending Transactions

- Ensure outstanding checks, debit card purchases, or deposits are processed.

- Double-check your account history to avoid surprises.

Download Statements for Records

- Access and save digital statements.

- Having records can help with taxes, disputes, or proof of past payments.

By preparing properly, you’ll avoid fees, payment failures, and future stress.

Step-by-Step Guide: How to Close a Chase Checking Account

Here are the four main ways to close your account:

Close Online via Secure Message (if eligible)

- Log into the Chase mobile app or online banking.

- Go to the secure message center.

- Request “checking account closure” and provide account details.

- Wait for confirmation from Chase support.

Close by Calling Chase Customer Service

- Call 1-800-935-9935.

- Verify your identity with account info, Social Security number, and recent transactions.

- Request account closure and ask about any remaining balance refund.

Close in Person at a Branch

- Bring a valid photo ID (driver’s license, passport, or state ID).

- Visit any Chase branch and request closure at the counter.

- The banker will confirm closure and issue a balance refund check if applicable.

Close by Mail (less common)

- Write a signed letter requesting account closure.

- Include your account number, address, and signature.

- Mail it to: National Bank By Mail, P.O. Box 36520, Louisville, KY 40233-6520.

What Happens After You Close Your Chase Checking Account?

Once you’ve requested closure, Chase will:

- Send a confirmation email or letter.

- Refund your remaining balance by check or transfer.

- Fully close the account within 3–5 business days (sometimes longer for pending items).

It’s smart to keep your new account ready and monitor old transactions in case anything slips through.

Fees and Penalties to Watch Out For

Closing a Chase account usually doesn’t cost money, but here are risks to watch:

- Early closure fee – If you close within 90 days of opening, Chase may charge a fee.

- Overdraft fees – Unpaid overdrafts must be cleared before closure.

- Outstanding checks – If someone tries to cash a check after closure, it will bounce, possibly leading to fees.

Always double-check your balance and transactions before shutting down.

Alternatives to Closing Your Chase Account

If you’re not 100% sure about closing, consider these options:

Switching to a Different Chase Checking Account

Chase offers alternatives like:

- Chase Total Checking® – everyday checking with broad access.

- Chase Secure Banking® – low-cost, no overdraft checking.

- Chase College Checking – designed for students.

Keeping as a Secondary Account

Sometimes keeping a Chase account open makes sense:

- Build stronger history with Chase if you want loans or mortgages later.

- Keep access to Chase’s nationwide ATM network.

- Maintain a backup account for emergencies.

Final Thoughts

Closing a Chase account is simpler than most people think. As long as you move your money, cancel autopay, and confirm closure, the process is quick and secure. Before closing, compare other Chase accounts or competitor offers to see what works best for your financial goals.

Frequently Asked Questions

Can I close my Chase account online?

Yes, through secure messaging in the Chase app or website (if eligible).

Does closing a Chase checking account affect my credit score?

No, closing a checking account doesn’t impact your credit directly.

How long does it take to close?

Most closures take 3–5 business days, longer if pending items exist.

Can I reopen later?

No, but you can always apply for a new Chase account in the future.

Is there a fee for closing?

Not usually, unless you close the account within 90 days of opening.